Digital Twins for Competitive Advantage

Most conversations about digital twins still start in engineering and end in the IT roadmap. That may be acceptable for large enterprises with deep pockets. It is not acceptable for small and mid-market manufacturers that live inside 6–9 month delivery windows and real capital constraints.

If you run a CNC, automation, packaging, or capital equipment business, you cannot afford a multi-year digital twin program with vague returns. You require a path where digital twins begin as a practical tool to improve specific decisions and, over time, create options for new service and revenue models.

This post builds on my earlier blogs on Physical AI, digital twins in cost estimation, automation design, and practical transformation roadmaps. The focus here is on how leadership should think about digital twins as a competitive lever, what use cases make sense in a 6–9 month horizon.

How Digital Twins Are Evolving

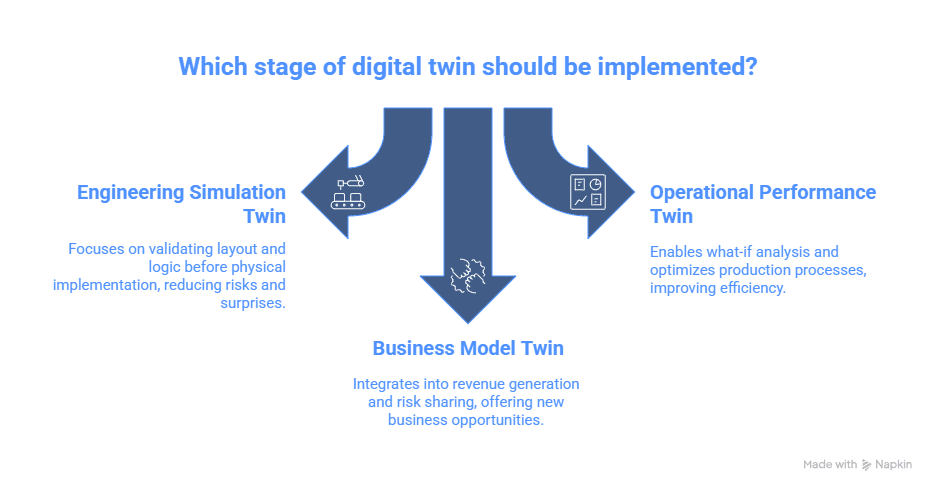

I think of digital twins in three stages of maturity.

Stage 1: Engineering Simulation Twin

This is where most manufacturers begin.

A virtual model of a machine, cell, or process

Used to validate layout, reach, interference, basic logic, and cycle time

Driven by CAD, offline programming tools, and simulation environments

The value is direct: fewer design rework loops, fewer assembly failures, and fewer surprises during commissioning. This is where many of my own digital twin projects started, especially for automation cells and cost estimation.

Stage 2: Operational Performance Twin

Here, the twin does not retire once the machine is installed.

Connected to runtime data from controls, sensors, quality records, and production logs

Used to analyze bottlenecks, test schedule options, and plan changeovers

Helps answer questions such as:

– How can we recover capacity without new machines

– What sequence or staffing pattern best meets this mix

– How do we reduce the “delay tax” that shows up as late orders and premium freight

Most small and mid-market manufacturers can realistically reach this level within 6–12 months, if they select use cases carefully.

Stage 3: Organization-wide and Business Model Twin

At this stage, the twin is part of how the business earns revenue and shares risk.

Product as a Service, Robotics as a Service, or uptime guarantee contracts

Predictive service subscriptions based on real-time performance

Usage-based billing where the twin records utilization and performance

This level requires more organizational change, legal and commercial design, and deeper integration. For many small and mid-market manufacturers, the right approach is to understand this direction and mention it in strategy conversations, but focus execution on Stage 1 and Stage 2 use cases that deliver returns inside 6–9 months.

Why Manufacturers Must Be Use Case Driven

Most manufacturers share the same constraints: Limited bandwidth; Fragmented systems; Stretched workforce; ROI.

A use case first approach means you start where three conditions intersect:

A painful business question that matters right now

A reasonable path to data and modeling using tools and information you already have or can obtain without major infrastructure projects

A measurable outcome within 6–9 months and no later than 12

Examples that meet this bar:

Automation and cell design

Use a simulation twin to de-risk a new robot cell or packaging line. The target is fewer commissioning days, fewer change orders, and smoother client handover.Bottleneck line operations

Create a performance twin of a bottleneck workcenter or line and test schedules, batches, and staffing patterns before touching the live system. Advanced planning tools such as Phantasma.global can complement this work.New Product Introduction (NPI)

Build a process twin for the first 6–12 weeks of production for a new product. Model routings, cycle times, staffing, changeover rules, and WIP limits. A simple model that captures planned routing and approximate cycle times can expose unrealistic assumptions before first manufacturing cut. For a mid-market manufacturer, that can be the difference between a calm launch and a three-month scramble.

Where Manufacturers Already Pay for “As a Service”

If digital twins are eventually going to support “as a service” revenue models, it helps to start with where manufacturers are already comfortable paying recurring fees for digital capabilities. Today, it is visible in at least three areas:

Monitoring OEE and machine performance

Using computer vision for quality inspection as a service

Cloud-based ERP and MES for production, traceability, and planning

In each case, the pattern is consistent:

Clear operational pain

Limited in-house capability to build and maintain the solution

Fast, visible payback

Willingness to treat the service as operating expense, not a one-time project

| Visibility as Service OEE and Machine Monitoring | Quality as a Service Computer Vision | System of Record as a Service Cloud ERP and MES |

Manufacturers now pay monthly or annual subscriptions for OEE and machine monitoring tools. These systems tap into CNC controls, track uptime and downtime, and provide dashboards and daily reports. Even a small improvement in spindle time or throughput more than covers the subscription. | Manufacturers introducing AI-based visual inspection already pay for it as a subscription service, quality as a service. They upload images, label defects, and deploy models to cameras on the line. The vendor maintains the platform and the models. A subscription model allows them to start small and scale without a large upfront investment. | Cloud ERP and MES are now standard. They pay per user, per month, for order management, inventory, production tracking, and quality records. Leaders accept this because it enforces some process standardization. The value is concrete: better traceability, fewer stock-outs, fewer data entry errors, and improved planning. |

| Today, this is visibility as a service. Over time, the same data streams can form the backbone of an operational twin of the shop, enabling scenario planning and performance-linked contracts in specific relationships. A shout-out to my good friend Srihari at LeanWorx, who writes entertaining and relevant posts on this topic. | The image and defect data, combined with process parameters, can become part of a product and process twin for critical SKUs, supporting traceability, root cause analysis, and even warranty and insurance discussions. Quality Assurance as a Service is a natural evolution in the manufacturing ecosystem. | These systems are, in effect, system-of-record as a service. As more operational and equipment data feed into them, they become the data spine for operational digital twins of lines, plants, or even supply chains. Vendors and partners can then layer planning as a service or capacity-analysis as a service using twin-like models. (Phantasma.global) |

Why XaaS and Twins Are Converging

The move toward “as a service” in manufacturing is not only about pricing. It reflects real pressure in three areas.

People

Leaders and planners do not have the time or skills to build and maintain OEE systems, vision models, or integrated ERPs. Their best people are tied up with daily production issues. They are willing to pay for services that remove complexity and provide ready-to-use insight. Digital twins will follow the same logic when they are positioned as a way to answer recurring questions, not as a technology project.

Process

Mix and demand change frequently, quality expectations continue to rise, and customers expect better traceability and responsiveness. Subscription services give manufacturers flexibility to start small, adjust scope, and change direction more easily than with a one-time capital project. Twin-driven services can fit into this by offering faster learning loops around capacity, quality, and launch decisions.

Technology

OEE tools, vision systems, and cloud ERP/MES are already collecting continuous data about machines, parts, processes, and events. That data is cleaned, structured, and surfaced as dashboards and reports that people actually use. Over time, these same data streams can feed more explicit twin models without asking manufacturers to start from scratch. The real convergence is that existing subscriptions are quietly building the data spine that digital twins need.

What Leadership Needs to Do Now

A manufacturing leader reading this should walk away with clear next moves for the next 6-12 months.

Choose two or three business questions that digital twins must help answer, grounded in current pain:

– De-risk a specific automation or NPI project

– Stabilize a known bottleneck area

– Improve visibility and trust with a key CMAssign a business owner and a technical owner for one priority use case.

Define outcome metrics that matter to the business and are measurable with existing tools, for example:

– Capacity released: additional productive hours per week on the bottleneck

– Inventory turns or days of inventory (or WIP days) for the line in twin

– Overtime or rework hours reduced on that scopeTime-box the effort inside a 6–9 month window. This is not a side experiment.

Decide your position on XaaS:

– Where you will pay for service and performance instead of owning everything

– Where, if you are an OEM or integrator, you might eventually offer performance-based offerings yourself

The detailed work of making processes, data, and people “twin-ready” is its own topic, which I will address separately. For now, the essential step is this:

Stop treating digital twin as something only large enterprises can afford.

Start treating it as a disciplined way to de-risk decisions, protect scarce capital, and build options for how you create and capture value in the future.