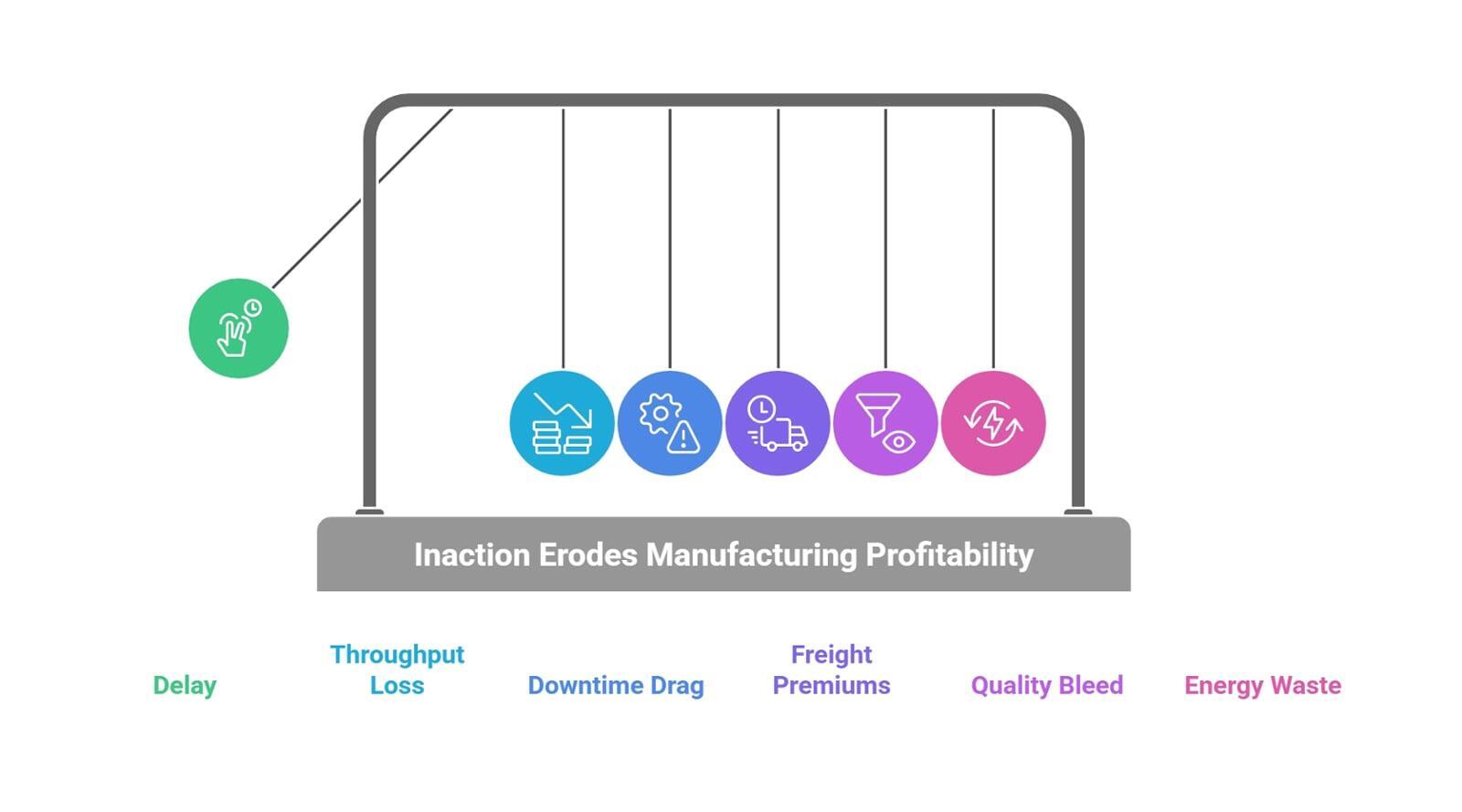

Delay Tax in Manufacturing

There is a reason leaders say: “It is better to make an imperfect move than to stay stuck in indecision.” In manufacturing, waiting is not safe. It is expensive.

Over the past month, I sat with two very different manufacturers—one a $2B global manufacturer, the other a $100M regional player. In both rooms, the conclusion was the same: “Let’s revisit this next quarter.” The technology was vetted. The use case was clear. The need was urgent. And yet, they hesitated.

Was it uncertainty about the vendor? A lack of clarity on internal priorities? Or something deeper—perhaps a hesitation to trust their own judgment on where to begin?

The conversation had already stretched six months. And in those six months, the problems that prompted the discussion were downtime, tribal knowledge loss, rework, expedite freight and continued to quietly eat margin and value. The cost of that delay, while invisible on the P&L, is real. Let us talk about what it adds up to.

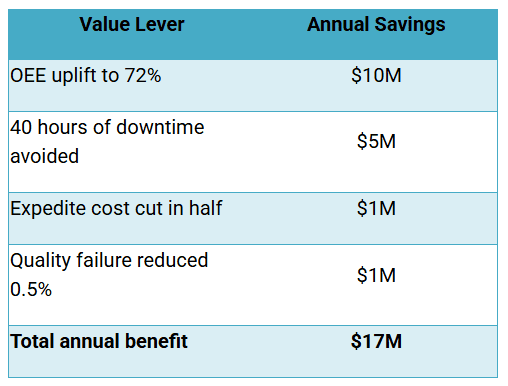

If you are leading a $200 million plant and defer digital investments by even 12 months, the present value loss can easily exceed $15 million. Let's take a straightforward look at where most plants bleed value, and how digital tools can close the gap.Top 5 ways the delay tax shows up

1. Missed Throughput is the OEE penalty

Most high-mix discrete plants operate around 60% OEE. Moving to 72% unlocks 20% more good units—without expanding footprint, capex or headcount. For a $200M site at 25% margin, that is an extra $10M/year in gross profit—if demand exists.

Even for demand-capped sites, OEE improvements cut labor premiums, short ships, and expedite costs.

2. Unplanned Downtime is the silent leak

If downtime costs $125,000/hour (common in regulated or constrained environments), 40 avoidable hours means $5M/year in savings.

Root causes often include maintenance gaps, poor changeover practices, or lack of operator response playbooks, which can be resolved through Connected Workforce tools for your workforce.

3. Premium Freight is the planning tax

Plants often spend millions annually on premium freight to chase schedule uncertainty, BOM errors, or poor supplier visibility. Halving a $2M expedite budget saves $1M.

Fixing this requires better material visibility and sequencing, achieved through better process control supported by ERP and MES capability.

4. Quality Costs via rework, returns, and reputational loss

Even a 0.5% reduction in external failure cost (via traceability, real-time defect alerts, or connected quality) creates $1M/year in bottom-line impact. This does not capture the hidden costs of audit exposure, and long investigations due to disconnected or paper-based systems.

5. Energy Waste impacts the wallet and the environment

Compressed air, pumps, and HVAC waste 20–50% of energy in typical factories. Metering, VFDs, and leak analytics pay back fast. A $200M site can unlock $500K–$1.5M/year in energy savings.

Two-year delay = ~$20M in value destroyed (present value at 10% discount rate).

Other hidden costs that compound delay:

Cyber incidents and ransomware

Lost contracts due to compliance gaps

Long ramp-up time for new operators (time to proficiency)

Knowledge loss from long-tenured employee exit

Extended product launch timelines

Excess safety stock and working capital bloat

How to Break the Delay Loop

A 12-month roadmap with 10–15 digital use cases tied to P&L impact

Replicable tools across sites, with shared digital backbone

Assigned owners for each use case, with tracked outcomes

Connected worker programs for faster onboarding and tribal knowledge capture

Reliability and energy analytics that self-trigger actions

Next step

- To identify your top use cases and digital roadmap, leverage the Smart Industry Readiness Index assessment and framework.

- Build your Manufacturing Technology Balance Sheet and quantify your delay tax. Use it to justify investments with real payback and to start the conversation at the boardroom table.

- If you would like to learn where to start, ask us!